Counterparty risk is the risk of one or more parties in a financial transaction defaulting on or otherwise failing to meet their obligations on that trade.

Counterparty risk is all around us when investing or making transactions. It is the probability that the other party in a trade, investment or credit transaction might default on the contractual obligation, therefore not fulfilling its part of the deal. It is also in investments we make in financial investment products such as stocks, bonds, and derivatives. These also carry counterparty risk.

Our daily lives are in this contractual world, but you have to think, do both parties always live up to their obligations?

Have you made an investment and that company or stock lose all the money invested or go bankrupt?

Another example, the default of so many CDO’s (collateralized debt obligations) was a major cause of the real estate collapse and in turn the global financial crisis in 2008.

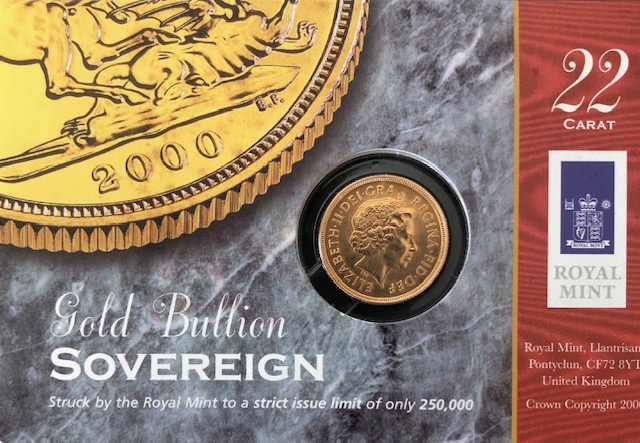

Physical gold has been traded for thousands of years. It is a safe form of investment and protection of wealth.

Gold can be traded anywhere across the world.

Gold is a real tangible asset which you can physically touch and has a known market price.

Gold is unable to go bankrupt, it is unable to default on payments, it does not need a board of directors and is not subject to large amounts of manipulation that are a huge risk in other standard investments.

BullionVault lets private investors around the world access the professional bullion markets. You can benefit from the lowest costs for buying, selling and storing gold and silver.

4 Grams of FREE Silver on Sign up! Visit BullionVault