Gold Vs Fiat.

Throughout history, excessive money printing always destroys paper currencies.

The current situation we are in right now is a perfect storm of trade wars, currency wars, conflict, spiralling debt, bankrupt businesses, bankrupt nations, the health crisis, unorthodox monetary policies and infinite quantitative easing, is all leading to a heightened risk of a global financial collapse.

Central Banks.

To keep this simple, let’s start with how Central Banks can influence the cost of money.

In basic terms, Central Banks can manipulate the cost of money by raising and lowering interest rates as well as increasing and decreasing the money supply.

If an economy experiencing a prolonged period of economic growth and activity that has led to high levels of inflation, then a Central Bank would usually increase interest rates to cool it down.

If the economy is struggling, then a Central Bank would usually cut interest rates to encourage spending.

Often when an economy is flatlining, then a Central Bank could increase the money supply to spur on growth, and when inflation becomes an issue, they would then aim to elevate too much inflation by shrinking the money supply.

These constant changes in rates and money printing by central banks are essentially ways for them to prevent high inflation or depressions.

A Central Bank in theory, is supposed to be separate from the government. The government have their own fiscal policy of essentially managing the budget for the country’s running costs.

The FED.

The FED or Federal Reserve for example, was created on December 23, 1913, when President Woodrow Wilson signed the Federal Reserve Act into law.

The aim of the FED was to ensure the smooth running of private banks and alleviate financial panics by being the lender of last resort.

As time went on, it seems that greed, corruption and simply banks left unregulated, led to a market meltdown in 2008 with the global financial crisis.

In order to prevent the whole system from collapsing, in 2008 the government essentially had to bail out the banks.

Governments had to increase spending dramatically to try and stimulate the economy and the FED and other Central Banks had to lower interest rates to encourage borrowing.

The 2008 financial crisis was so severe that extreme measures had to be taken. The FED and the European Central Bank had already dropped interest rates to close to zero, but they needed more stimulus, so what did they do?

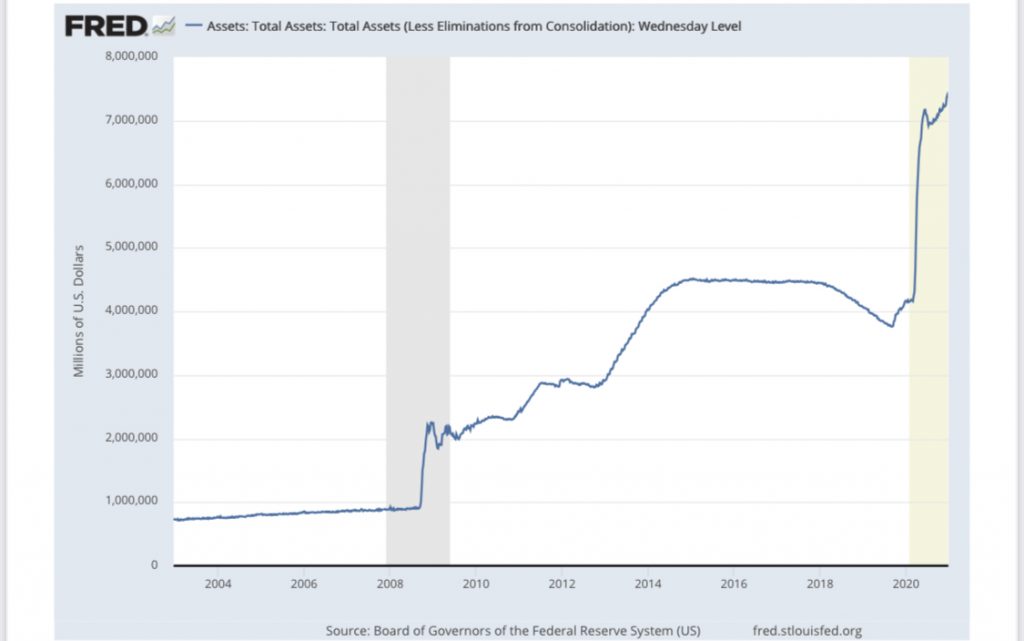

They printed a lot of money. This new money was given the term ‘Quantitative Easing’, which is essentially printing money out of thin air.

The powers that be reassured the public by explaining this would only be a temporary measure to stabilise the economy, however this excessive money printing is still happening to this very day and has now reached truly extraordinary levels.

To put things into perspective, a trillion seconds is equal to just over 31,688 years. In the U.S. the Federal Reserve balance sheet is now over $7 Trillion.

The U.S. National debt is now over $27 Trillion. (Source)

The money trap.

The FED is now in a trap.

Raising interest rates would essentially bankrupt an already overly-indebted government, as well as completely destroy the private sector due to it also having excessive debt.

With interest rates at practically zero, all this ‘free’ money has fuelled an even bigger speculative bubble in the stock market, raising rates now would cause the bubble to burst.

Because the FED is buying up mortgage backed securities and other assets, raising rates would also in theory cause major solvency issues for the FED itself. It is trapped with no way out.

The increase in the wealth gap.

In the real economy, main street has been struggling for some time as average wages have not been able to keep up with the cost of living.

Many people seem to deny that major inflation even exists at this moment in time.

However, the fact is, why would wages need to rise if we don’t have inflation?

With all the cheap money and money printing going on at the moment, the main group of people who have benefited are the big financial institutions who got bailed out by the government straight away, as well at those people wealthy enough to borrow money at next to nothing and buy real assets like stocks and property etc.

The small to mid-size businesses have been left to try and scrabble for whatever scraps of money are left to keep going for a few more months, while the average worker is struggling to get by. All while, unemployment continues to hit record highs.

All this is adding to the debt pile, not only public but private debt as well.

We now seem to be in a situation whereby interest rates are not going higher any time soon and money printing is going to continue at pace.

In fact, the Fed’s Vice Chairman Richard Clarida recently indicated that the Fed’s monthly purchases of U.S. Treasury’s and mortgage-backed bonds should continue at the same $120 billion-per-month pace all year!

Read more about the expanding money supply here.

Gold.

Buy physical gold and silver (high-quality bullion bars and coins) in secure storage, outside the banking system with GoldBroker.

Gold can really benefit from this environment.

As interest rates are stuck at next to zero and could even go negative, gold suddenly becomes more appealing to many investors looking to preserve their wealth and their purchasing power.

As this current crisis continues Central Banks are unable to lower rates any further, the only option they have left to stimulate the economy and to stop financial collapse, is to print copious amounts of money, thereby diluting the money supply.

When a country’s government resorts to printing endless amounts of money then history shows time and time again that the currency eventually becomes worthless.

Gold shines as the ultimate safe haven for those who were savvy enough to preserve their wealth in safety of gold.

Gold is real money, as it always has purchasing power no matter what happens to fiat currency.

Buy physical gold and silver with GoldBroker.