Gold is a Tier 1 asset, held by Central Banks around the world.

Tier 1 is regarded as the most valued and conservative type of capital, and the world’s central bankers are making gold more important to banks’ balance sheets for stability.

Although not widely broadcast, gold is actually an established monetary asset with literally thousands of years of history behind it being used as a form of money.

Physical gold counts as capital in the same manner as a treasury bond, therefore, for gold, banks around the globe follow the rules established by the Bank for International Settlements (BIS).

Essentially the BIS recognise central banks’ holdings of physical gold as a reserve asset equal to cash.

What is the Bank for International Settlements?

Most countries have a Central Bank or similar entity, who are ultimately in charge of the country’s monetary system.

This can include increasing or decreasing the money supply.

The BIS is located in Basel, Switzerland, and is essentially a Central Bank for all Central Banks.

The BIS is there to support central bankers with payment processing, assist with monetary policy and ultimately, maintain the stability of the world’s banks.

189 banks follow the rules established by the BIS.

Basel III

A series of central banks from 28 countries published Basel III in 2009.

Basel III was an international regulatory agreement that introduced a set of rules and reforms designed to improve the regulation and risk management within the banking sector.

BullionVault lets private investors around the world access the professional bullion markets. You can benefit from the lowest costs for buying, selling and storing gold and silver.

4 Grams of FREE Silver on Sign up! Visit BullionVault

In a sense, this was a reaction to the credit crisis in 2008, as central banks needed to be seen to be learning lessons, as it were, from the financial crisis.

Each bank must have a minimum level ratio of capital to loans, and this capital ratio is based upon approved tiers of asset classes.

Gold is the only other tier 1 asset in the world next to U.S. dollars in Treasuries, and central banks can count their gold holdings, marked to market, as equivalent to cash.

Essentially, gold bullion is considered risk free.

Central Banks are buying up gold.

Central banks see tremendous value in holding physical gold bullion.

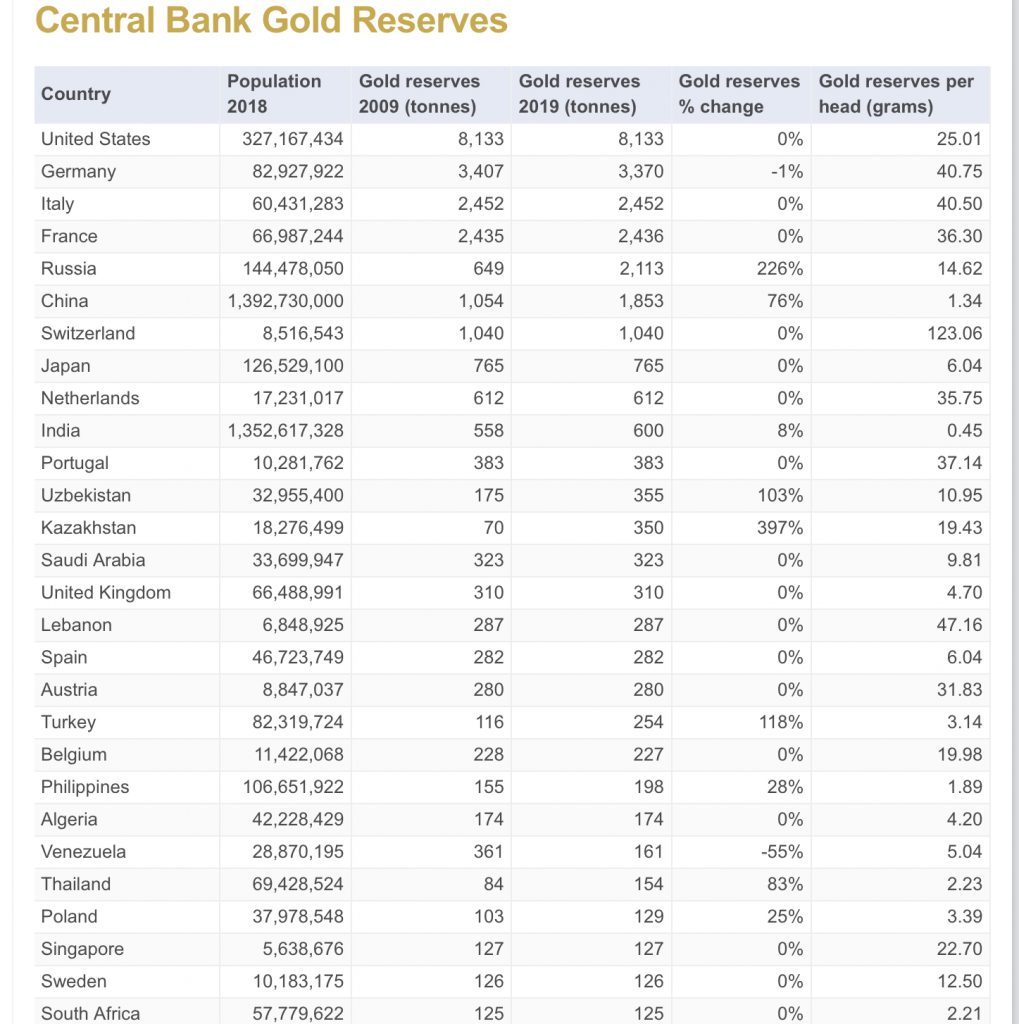

Since 2018, central banks around the globe have bought more gold than at any time in the previous 50 or so years.

Central Banks in China, Russia, India, Turkey, Hong Kong, Egypt, Indonesia, Mongolia, Kazakhstan, and others, have been on a gold-buying spree.

If the world’s central banks and elite are buying up as much gold as possible right now, does this mean that these insiders know something about upcoming financial changes that we don’t?

Is the big money looking to reposition ready for gold to take-off as we are starting to see signs of the beginning of the end for the U.S. dollar?

With the mismanagement of the world reserve currency (the U.S. dollar) and the countries spiralling national debt, it seems that the smart money is running to the safety of gold.

BullionVault is the world’s largest online investment gold service taking care of $3 billion for more than 85,000 users.

4 Grams of FREE Silver on Sign up! Visit BullionVault