2020 has been a turbulent time for the financial markets to say the least.

As we move into 2021, the crisis continues. Boris Johnson has now announced further lockdowns, restrictions, school closures and more.

Many businesses are already simply hanging on by a thread.

Are there any safe assets during these turbulent times?

The global asset bubble.

We are now surely entering into the end game for the giant global asset bubble, which over the years has been fuelled by ridiculous amounts of debt.

Major economies around the world have been perpetuating these asset bubbles of stocks, bonds and property with quadrillions in money printing, derivatives and easy credit.

Whether financial markets peak now or climb slightly higher is now becoming irrelevant as signs are pointing towards a major correction in the stock markets.

The coming market and debt collapse could be triggered by a number of events.

We ultimately need to be aware that the world economy is in shutdown mode, with many businesses unable to trade properly.

Debt across the globe has exploded as the virus crisis continues to cause havoc to many an economy. This debt is likely to turn into junk.

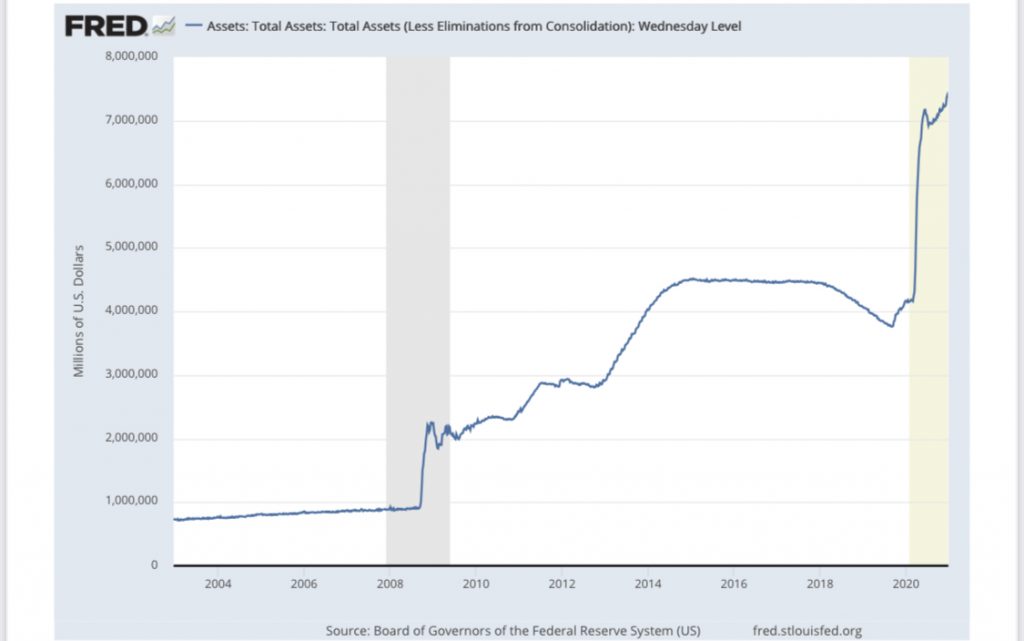

Quantitative Easing has flooded the markets with worthless money.

With unemployment hitting record levels, high streets and city centre’s shut down, large business going bankrupt left right and centre, the only way governments and central banks can keep the bubbles inflated is to keep printing more and more and more money.

The total amount of Quantitative Easing by the Bank of England has now hit an astonishing £895 billion, of which £20 billion is non-financial investment-grade corporate bonds.

In the U.S. the Federal Reserve balance sheet is now over $7 Trillion.

What is Quantitative Easing? Read more here.

The European Central Bank has also undertaken aggressive QE programmes.

With world trade struggling and businesses faltering, the stock market investors live in a parallel universe, whereby fake money created by central banks out of thin air continues to prop up these markets.

However, the day is fast approaching whereby fundamentals and reality will hit home hard when they realise that real wealth does not come from a central banker printing trillions in currency units.

The bubble markets in stocks, bonds and property, are now becoming incredibly risky.

With global debt spiralling out of control, what is the answer?

BullionVault lets private investors around the world access the professional bullion markets. You can benefit from the lowest costs for buying, selling and storing gold and silver.

4 Grams of FREE Silver on Sign up! Visit BullionVault

Is gold the answer?

Gold has outperformed major asset classes, including stock markets this century.

Gold was an excellent asset to hold as insurance and wealth protection throughout 2020, and has proven itself as the ultimate safe haven asset.

With the continued global financial uncertainty, gold could easily trend higher as more and more people rush in to preserve their wealth during these turbulent times.

Although gold is up, this could well be just the start of a major bull market in gold.

Gold has completely unique properties, which makes it an ideal asset to hold at this present time.

Gold is real money, it is a hedge against inflation, it is also a crisis hedge together with the fact it is no one else’s liability.

Gold has also survived as money for thousands of years, whereas fiat currencies over the years have come and gone.

The world is going through major financial changes right now!

Not many people are fully prepared for these changes.

Having at least some portfolio allocation in physical gold will no doubt give you ultimate protection against the systemic risks in the financial system in 2021 and beyond.

BullionVault. It’s free to open an account with BullionVault and registration takes less than a minute. There’s no obligation to trade.

4 Grams of FREE Silver on Sign up! Visit BullionVault