Expanding money supply.

The U.S. Federal Reserve’s new monetary policy allows for overshooting the inflation target, as well as expansion of the public debt and the overall money supply.

This is supported by Qualitative Easing and increasing bank deposits. You can read more about Quantitative Easing here.

The money supply (or money stock), is the total value of money available in an economy at a point of time.

There is vast evidence of a direct relationship between the growth of the money supply and long-term price inflation.

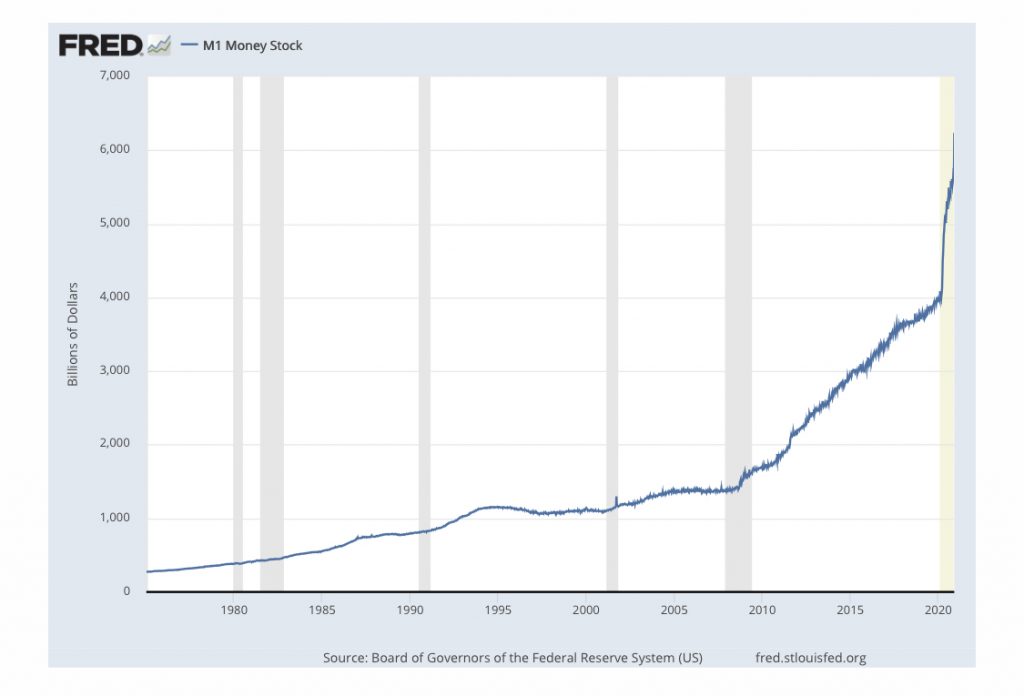

M1 money supply is expanding.

M1 money supply or money stock, is a measure of the money supply that includes physical currency, travelers’ cheques, demand deposits, currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions.

M1 covers types of money commonly used for payment.

This chart shows a sharp rise in the U.S. M1 ‘Money Stock’ in 2020.

In the U.S., the M1 money supply has increased 55% since February 2020.

Astonishingly, this means that 35% of all U.S. dollars in existence have been ‘printed’ in the last 10 months.

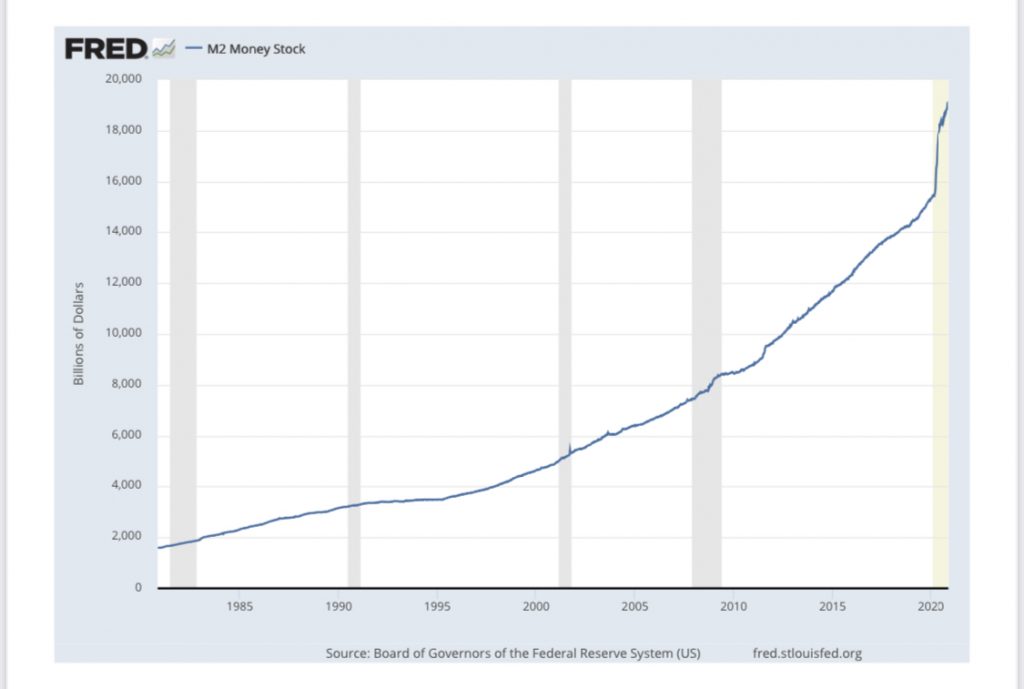

M2 money supply.

M2 includes M1 while also including capital in savings accounts, money market accounts, retail mutual funds, and time deposits.

M2 is mainly used as a form of classification for the money supply in the eurozone and the U.S.

In the UK however, the official classifications are limited to M0 and M4. M0 is referred to as ‘narrow money’ and M4 is referred to as ‘broad money’

M1/M0 are used to describe narrow money, M2/M3/M4 qualify as broad money and M4 represents the largest concept of the money supply.

As all the world’s currency is pegged to the dollar, the expansion of the money supply in the U.S. has knock-on effects.

The overall increase in the money supply doesn’t automatically translate into higher inflation, but the sheer speed and volume of expansion in the broad money supply is somewhat concerning.

You just have to look at Zimbabwe which saw extremely rapid increases in its money supply, which then led to rapid and out of control increases in prices, this is known as hyperinflation.

There is now a real risk of major inflation or stagflation (slow economic growth and relatively high unemployment and at the same time accompanied by rising prices) in the not so distant future.

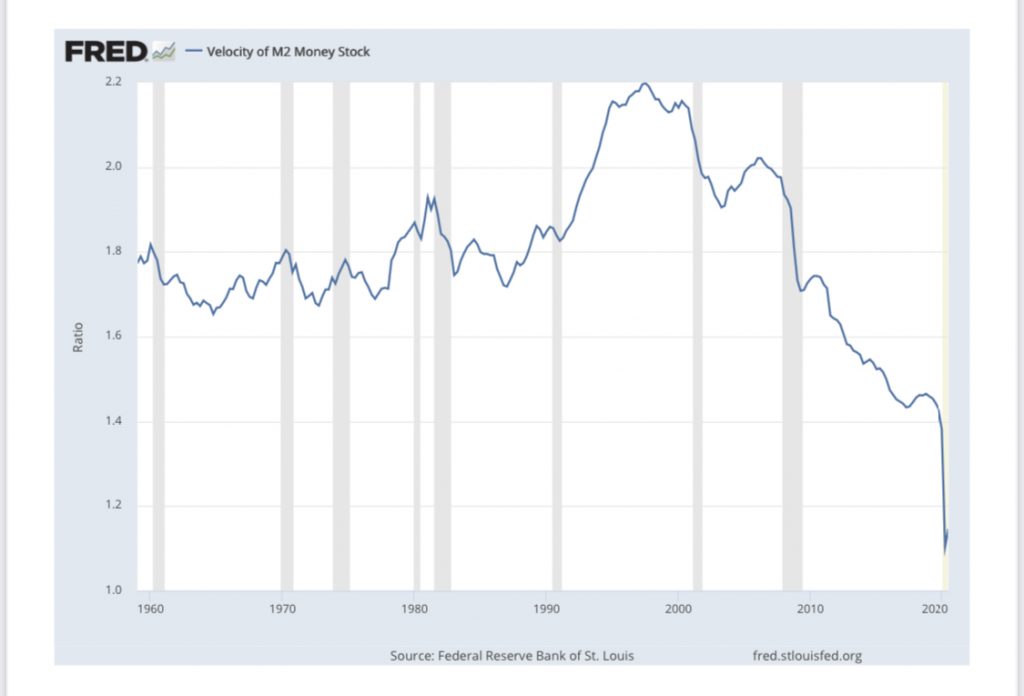

Velocity of money.

The velocity of money is a measure of the number of times a unit of currency is used to purchase goods and services within a given time period.

If the velocity of money is increasing, then transactions are occurring between individuals more frequently and vice versa.

As you can see by the chart below, the velocity of money has recently fallen off a cliff.

This is a particularly interesting, as at this moment in time, even though the money supply is expanding at an alarming rate, the velocity of that money is slowing down, therefore the money is not being spent or circulated in the real economy.

Eventually however, velocity will pick up and all that newly created currency will come flooding back, potentially causing rampant inflation.

Gold vs inflation.

Buy physical gold and silver (high-quality bullion bars and coins) in secure storage, outside the banking system with GoldBroker

Gold as an inflation hedge.

Gold is often seen as a great way to preserve wealth during times of runaway inflation.

For example, if you bought an item for $1 in 2000, that same item in 2020 would cost you $1.49. A cumulative rate of inflation of a staggering 48.9%.

In simple terms the U.S. dollar has lost over 90% of its purchasing power since 1950, mainly due to politicians and the federal reserve printing more of them.

Even though the price of gold has been increasing over the last few years, there is strong ongoing support and upside for gold.

As the U.S dollar and paper assets continue to plummet in value, investors will find it increasing difficult to ignore the true value of owning gold as a way to truly diversify their investment portfolio.

In essence, gold is an ideal store of value and retains its purchasing power, as it does not have the same inflationary pressures as do the dollar and other fiat currencies.