Many people are still under the impression that banks work in a simple way.

You depot your money into your bank, the bank looks after your money and gives you a small amount of interest. That money is then used to loan out to other people or businesses and the bank charge them a slightly higher rate of interest, that is where a bank makes its money right? Well unfortunately this is completely wrong.

The risks of fractional reserve banking.

More people are now aware of fractional reserve banking, which is a new understanding of how banking works and how the money created is based on a fractional reserve system.

Essentially it is a system that allows banks to keep only a portion of customer deposits on hand while lending out the rest.

You put your money in the bank. As soon as you do that you are no longer the owner of that money. The bank now effectively owns that money and can do whatever it wants with it.

Using a standard fractional reserve system a bank would technically need to hold back around 10% of the money you have deposited in the bank as a ‘reserve’, just in case you want some of that money. The other 90% is then essentially lent out.

Therefore, if you have deposited £100, that bank has the option to give the remaining 90% (£90.00) in the form of a loan. At the same time, the bank is still obligated to immediately pay back the £100.00 to the depositor if they decide to withdraw it. This system only works when the amount of deposits continues to exceed the amount of withdrawals. The bank can fail if too many people withdraw money. (Northern Rock for example).

When you deposit money into your account, the bank shows the full amount of the money in your account balance.

But remember the bank is technically allowed to lend out 90% of your money (deposit) to other customers. This essentially almost doubles the amount of money in the economy.

With this system, you then have a money multiplier effect, meaning that if someone (person A) borrows money from a bank, then they go off and buy something like a car, the seller (person B) then deposits that money from selling the car into their bank. That bank, then uses the fractional reserve system again, even though the money was borrowed from another bank. The bank of person B holds 10% of the money in reserve, and loans out the rest to person C who buys something. Again a seller deposits the money in their account and the whole process just keeps multiplying.

The cycle, known as the money multiplier.

Nowadays, the fractional reserve is more the mechanism by which how much money the bank needs to retain in order to to issue personal andcommercial loans.

From a personal perspective, the credit to loan ratio depends on the overall asset value the individual can tender, and essentially the collateral you canput up if you can’t meet their risk portfolio individually.

Bank runs.

The whole system of fractional reserve banking relies on the assumption that people typically don’t need access to all of their money at the same time.

However, in a financial crisis there is an increased risk that customers fear that a bank or the financial system is in deep trouble, and everyone tries to withdraw funds at the same time known as a ‘bank run’.

In this scenario, the bank simply would not have enough money to satisfy the withdraw requests, so the bank could become insolvent.

Zero reserve.

In the U.S., The Federal Reserve reduced required reserves to zero on March 26, 2020.

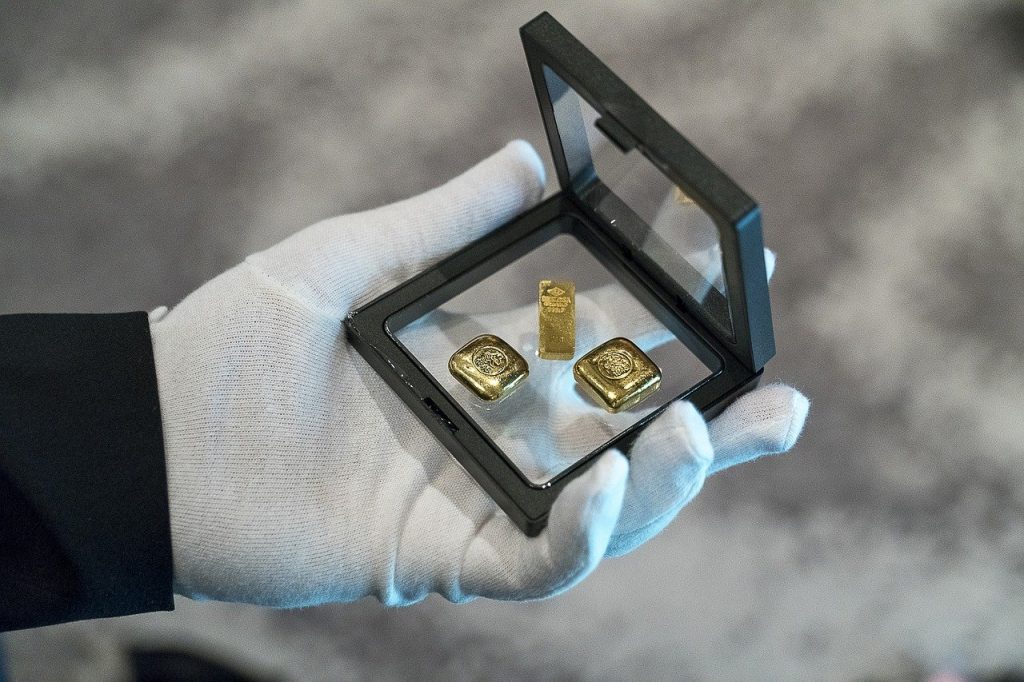

The safety of gold.

Buy physical gold and silver (high-quality bullion bars and coins) in secure storage, outside the banking system with GoldBroker.

Gold has played an important role as a physical reserve of value for thousands of years.

The level of public and private debt has reached epic levels that now make it impossible to fully reimburse.

With such a complex and interconnected financial system, default from one of the major sections in the economy could trigger a collapse of the financial system.

Gold is the ultimate safe haven asset.

Gold is a tangible and liquid asset that is neither backed by debt or the responsibility of a third party, it has no counterparty risk.

Gold can be stored outside of the banking system, protecting your wealth from the risks of fractional reserve banking, debt and systemic collapse.